FM Group Newsletter

Spring 2022

Introduction

FROM THE DIRECTORS

Welcome to the Spring edition of our newsletter.

With 2022 coming to an end, it has been very much a year of changes. Shipping rates moving up and down by $30 USD, CFR export prices moving down by $40 and costs of fuel rising by over 100%! Along with that the carbon market has moved from mid $30’s to mid $80’s.

This year FMG planted approximately 5,000 ha of new planting and planning to do the same area in 2023. With this comes the challenges of getting the jobs done with shortages in supply of seedlings, labour and chemicals to get the trees in the ground. Along with pressure on planting ”productive“, not necessarily profitable, farmland out into trees becomes a political point in some lobby groups. In the meantime the farmers become the biggest planter of trees, with a lot of the new forest planted complimenting the farm income and off setting emissions.

Meanwhile the China log market is struggling to get momentum with demand dropping due to a variety of factors, like the China government policy on Covid (having aggressive lockdowns is slowing productivity). Combined with the fall of the value of Yuan against the USD, along with the property market lacking confidence in new builds. While NZ logs are competitive to lock out other suppliers like South America/US mainly, the simple demand needs to be there to ensure we can get guaranteed payments. So it may be an extended Christmas break this

year as Chinese New Year falls early, here’s hoping for confidence after that. Currently no one is holding their breath.

It’s going to be a hot La Nina summer with climate changes occurring, and a place we haven’t seen in markets for a long time, but NZ products remain competitive on the export front and our economy (while not rock star status) appears to be faring better than others.

Evan MacClure

Director

Log Market Update

Just when we thought the market was getting tough, it appears to get even tougher. China is still battling low production due to Covid shut downs and a lack of economic confidence from developers. While the government is trying to create incentives for new home builders while areas are in lockdown no income makes it impossible for them to get loans and repay mortgages. With no change in sight for Covid policies and the USD/CNY rate strengthening it is making it harder to see demand lifting in the short term.

Inventory levels are low which is encouraging and log prices are probably at a level that may spur demand if strong incentives occur and a change in Covid policy, but we can’t see this happening in the short term. At present the offtake is around 40,000 jasm3 per day and inventory in early November was around 3.79m m3 which is down from last month by 800k.

Ocean freight is also down to around the $43-46 USD mark for the South Island and $36-38 for the North Island, this along with a lower USD/NZD has cushioned to blow a small amount, but over all we have seen a drop in at wharf prices for November and December.

While theNZ domestic demand is still strong we are seeing a fall of new building consents in some areas, this combined with banks lifting interest rates will put the pressure on new builds for new home owners. Some areas like Central Otago or Queenstown are still busy but this is the exception to the rule. Local log demand appears steady but not ramping up. And in some areas wood for fuel is gaining some interest.

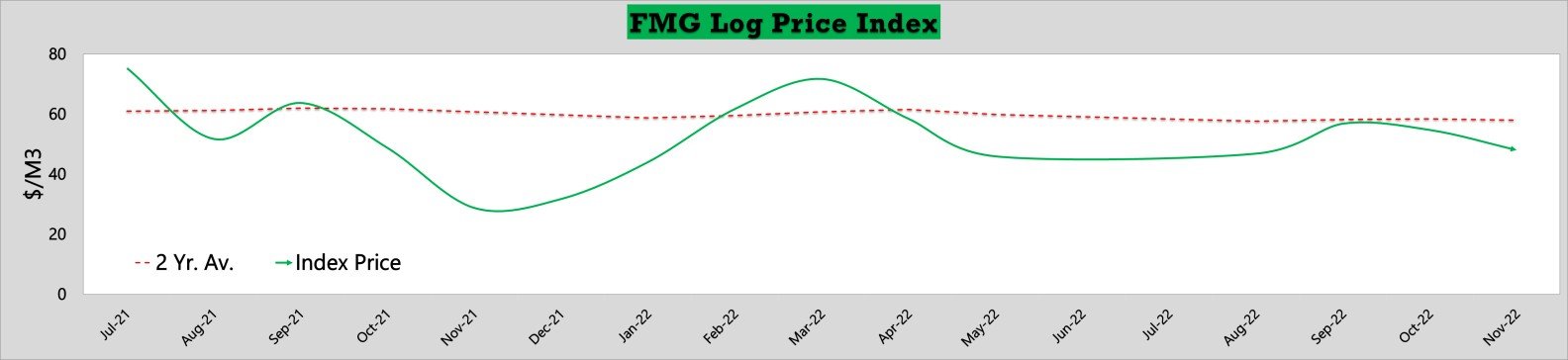

FML Log Price Index

Forecast

Usually, this time of year in a normal market condition we would expect to see demand lifting and constant through to April 2023, but with Chinese New Year early this year, Covid, lack of confidence in building, rising costs etc. we see the next two months tough until after Chinese New Year at least. While prices are low in all markets, India, Korea and China will be short of wood when demand picks up due to a lack of consistent supply from anywhere else. NZ forest owners are well positioned to supply these markets at competitive prices and our local processors should be able to buy logs for the demand into 2023 as we look to balance the risk of export and domestic sales. Overall, I think we need to get through the next 3 months, usually after every price drop, war or pandemic there is a surge in demand as economies recover. The big question is when ?

Emissions Trading Scheme – Carbon Price Update

The Emissions Trading Scheme (ETS) is a market-based policy tool designed to reduce greenhouse gas emissions by putting a price on pollution. Participants are required to buy carbon credits (NZUs) to offset their emissions. Each NZU equates to 1 tonne of carbon dioxide.

The carbon price has fluctuated throughout 2022 but has continued to follow an overall upward trend so far this this year.

NZU peaked at $88.50 before dipping as low as $78.00 in September.

October prices have traded in a range of around $80.00 – $82.00 for most of the month. Towards the end of the month we have seen the price recover, with trading on 31st October at the $85 per NZU mark.

The carbon market is awaiting a bit of news with the major one being the government’s decision on the Climate Change Commission’s recommendations on auction volumes and price limits.

The recommendations

Compared to current settings, the Climate Change Commission recommended:

Reducing the limit on the number of units available for auction

Raising the trigger prices for the cost containment reserve and auction reserve price

Changing to a two-tier cost containment reserve from 2023

The consultation closed on 6th October and we are yet to see a response from the government. A decision must be announced by the government before the end of the year. We expect the decision by the government on these settings will be a driver of carbon price so watch this space.

Emissions Trading Scheme – Key Updates

ETS key updates

There have been multiple changes within the ETS recently and we would like to update you on the changes to ETS requirements going forward. We have summarised the key information below for your reference.

ETS Management Contracts

Due to ETS compliance and management requirements, we now require all ETS clients to be under a management contract for undertaking ETS related services.

We have developed an ETS Management Contract and will be providing this to clients (new and existing) for signing.

Mandatory Emission Return Period

At the end of the current Mandatory Emission Return Period, all ETS participants are required to submit a Mandatory Emission Return prior to the 31st June 2023.

As part of this Mandatory Emission Return, we will need to ensure that your forest is 100% ETS compliant at the time the return is submitted. Failing to do so results is significant penalties issued from MPI.

In order to undertake the upcoming Mandatory Emission Return Period Returns, we will require an ETS Management Contract to be signed.

Penalties for errors in emissions returns

If MPI find that a penalty applies for errors in an emissions return, they base this calculation on:

the size of the error

their assessment of the reasons behind this error

the current carbon price

whether they were told about the error voluntarily

The compliance process within MPI is strict and cannot be avoided if a participant is non- compliant. It is far easier to ensure compliance at the beginning than enter MPI’s system.

Averaging accounting vs Stock change accounting

If you have a forest where the application occurred after 1st January 2019 and the land was registered before 31st December 2022, you can choose to move those forests to ‘averaging accounting’.

If you decide to move to averaging, we will need to notify MPI and complete a special emissions return.

The best accounting method depends on individual circumstances, and we will provide you with advice on the best option given your specific situation.

Adverse event cover

There is a new exemption from carbon liabilities for those with forests that have been partly or fully cleared by a temporary adverse event. Previously a participant would have been required to repay the carbon credits in this situation.

Adverse event cover has no requirement to pay back any loss of credits if approved by MPI.

An adverse event is fire, landslides, wind etc. and this requires no carbon payback.

This is an opportunity to reduce carbon loss insurance costs for ETS registered forests.

Adverse events must be notified prior to a carbon credit claim being made. This is important as the forest owner will be deemed non-compliant if a claim is made before the adverse event is notified.

To ensure compliance we will need to assess ETS registered forest areas following an adverse event.

Permanent forest category

The new permanent forestry category will become available next year for post-1989 forests in the NZ ETS that will not be clear- felled for 50 years after it is registered as a permanent forest.

This requires a 50 year commitment and must be managed to maintain forest cover.

Please contact us to discuss these requirements if you are considering the permanent forest category to discuss the key points surrounding this decision.

Please do not hesitate to contact us to discuss any of the above updates in relation to your specific ETS registration.

Emissions Trading Scheme

Forest Management Group has been involved in working with the Emissions Trading Scheme (ETS) since forestry became a participant in 2008.

Carbon in forestry adds a significant new income stream to traditional forest investment. The carbon market holds huge potential for forest owners as further industries are required to offset their emissions.

Forest Management Group offers specialist services in the ETS and can undertake work in a variety of areas including:

Mapping of potential ETS eligible areas

Registering post-1989 forests into the ETS

Managing carbon flows to understand repayment obligations

Planning and managing new planting projects

Establishment of joint ventures

Carbon forecasts and advice

Carbon credits sales

Canterbury West Coast Wood Council Awards

The inaugural Canterbury West Coast Wood Council awards were held at the Air Force Museum in Christchurch on 19th August 2022.

The event recognised and celebrated exceptional businesses and individuals from our forestry and processing communities.

FML is proud of our staff member, Adrian Loo, who received the ‘Forestry Influencer of the Year’ Award, for his contribution to the industry.

FML congratulates all award recipients and nominees. A special mention to our own contractors;

Alan Nichols from Davaar Logging – Harvesting Excellence

Steve Murphy Ltd – Training Company / Contractor of the Year

Owen Fisher from T Croft Ltd – Distribution Excellence

Woods Logging Ltd – Outstanding Health & Safety Management

A great night was had by all with a big crowd of more than 400 forestry members and their families, including Ministers of Parliament Stuart Nash and Megan Woods.

Chairman of CWCWC – Glenn Moir’s opening speech

Forestry Influencer of the Year

From the Backpage

Scott Henry has been with Forest Management for over 12 years and is now moving on the enter the world of International Forest Investment. In that time he has lead the establishment of many 1000s of ha of forest planting, running large and complex establishment programmes.

He also introduced many here to the wonders (or horrors) of Godzone and other multi-sport activities. We wish Scott all the best in his new endeavours, and he can be very proud of the many areas of forest he has established over the past decade.

The Forest Management Group AGM was held at the beginning of October in Naseby.

We discussed all things forestry and our strategy for the next few years. It seems like we have to stick with what we do best, as we are not going to make it to the Olympics for Curling :-)